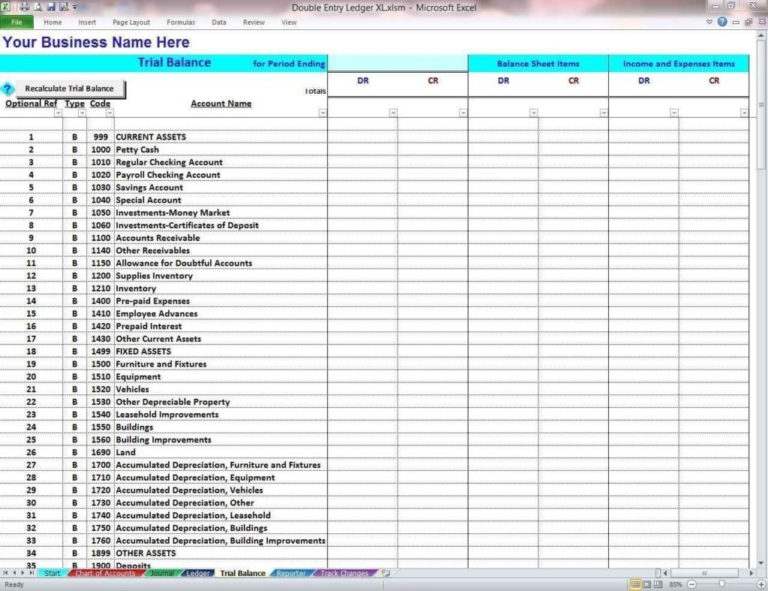

- #Baker system of double entry bookkeeping trial

- #Baker system of double entry bookkeeping professional

Office Angels UK is an Equal Opportunities Employer.īy applying for this role your details will be submitted to Office Angels. Office Angels acts as an employment agency for permanent recruitment and an employment business for the supply of temporary workers. Office Angels West End branch look after roles in the following locations and all areas in between: Oxford Circus, Oxford Street, Covent Garden, Tottenham Court Road, Euston, Regent Street, Piccadilly, Leicester Square, Camden, Bond Street, Marble Arch, Marylebone, Mayfair, Baker Street, Edgware Road, Regents Park, St Johns Wood, Primrose Hill, Paddington, Hampstead. If you have not heard after 5 working days then unfortunately we were unable to consider your application on this occasion. Every entry to an account requires a corresponding and opposite entry to a different account. Due to the high volume of applications we receive we do ask for your patience to wait to hear from the consultant rather than to call us directly. Double-entry bookkeeping, also known as double-entry accounting, is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information. All successful applications will be contacted within 5 working days. Thank you for your interest in this role. This opportunity is being advertised by the Office Angels West End team. In other words, every time you make a sale, its also recorded as an expense. Good communication skills and happy liaising with clients Double-entry bookkeeping is a system of accounting in which every financial transaction is recorded in two places.Ideally experience of working within an Accountancy Practice environment.Client management including filing and general administration of client companies.

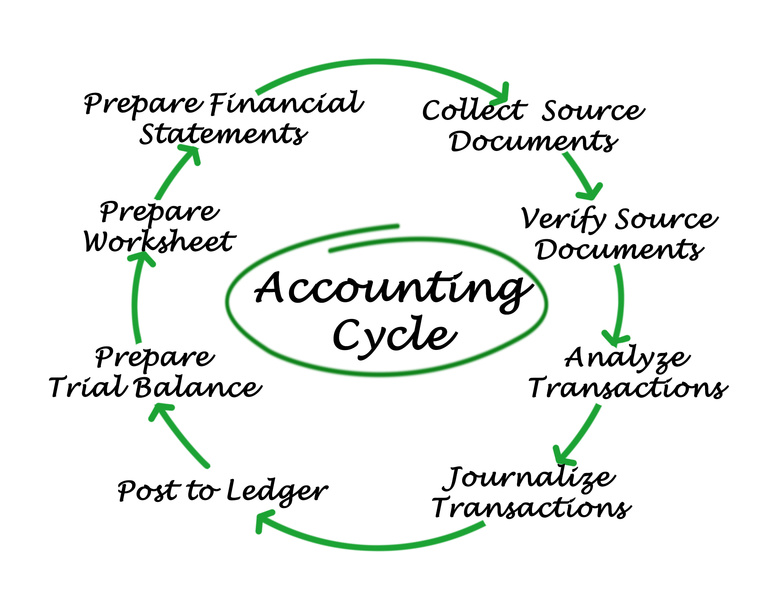

The beauty of the system is in its ability to generate these reports any time you want. Double-entry allows you to generate a statement of cash flows, balance sheets, and more detailed income statements. Filing ans general ad hoc administration Double entry accounting is the standardised method of recording every financial transaction in two different accounts within the general ledger. Single entry accounting can help you create an income statement earnings, costs, profit but falls flat on other major reports.Filing Annual Returns and assisting with end of year returns.Liaising with clients via telephone, e-mail and post.On boarding clients and setting up new accounts.

Working as part of a team your role will involve.

#Baker system of double entry bookkeeping professional

I am seeking a hard working Accounts professional who has good attention to detail and has ideally worked within a practice environment previously. This is a great opportunity for you to progress within a business and learn new skills, providing assistance for clients and liaising with them on a daily basis with queries they may have. Window = 'AOuZoY71tc2I7tS1O5hjimkOkJmaTLQtvA:1696482847597' _WidgetManager._Init('//_WidgetManager.My client are a growing Accountancy practice based in the West End who are seeking a Accountant to join them on a permanent basis.

#Baker system of double entry bookkeeping trial

The trial balance can also be used to determine the financial status of a business by generating a balance sheet and determining operating performance by preparing an income statement. For example, if the owner of Razor Bakery buys sugar worth Rs 50, she is. A trial balance can be generated using this system to check the arithmetical accuracy of all accounting entries of a business in a given period. terms as the liabilities entries are derived, each pair from one entry on the assets side.It maintains a balance within the records, which aids in the detection of errors, omissions, and frauds.

The two aspects of each transaction are recorded in the double entry system of bookkeeping.

0 kommentar(er)

0 kommentar(er)